Choosing the right tools is a critical step in building a sustainable freelance career. While spreadsheets can handle basic income and expense tracking, they quickly become a liability for professional invoicing, tax compliance, and gaining a clear view of your financial health. A spreadsheet won’t chase an overdue payment for you, nor will it streamline your Self Assessment tax return. For creative studios, marketing agencies, and independent designers, a dedicated platform is essential for professional financial management.

This guide moves beyond simple lists to offer an in-depth analysis of the 12 best accounting software for freelancers operating in the UK. We explore platforms designed specifically for sole traders and small businesses, focusing on features that genuinely save time, ensure you meet HMRC's Making Tax Digital (MTD) requirements, and help you get paid faster. For those looking to dive deeper into the overarching principles and requirements of managing their finances as a self-employed professional, a comprehensive guide to accounting for contractors can be invaluable.

Each review is built around practical use cases-from sending your first professional invoice to preparing for tax deadlines-so you can make an informed decision that supports your business's growth. We will examine each option with screenshots and direct links, helping you visualise how each platform works in a real-world scenario. You will learn precisely which software suits your specific needs, whether you prioritise mobile invoicing, automated expense tracking, or integrated business banking. This list is designed to help you find the perfect fit, saving you hours of research and preventing costly administrative headaches down the line.

1. Xero (UK)

Xero positions itself as a robust, all-in-one cloud accounting solution specifically tailored for the UK's self-employed market. It’s one of the best accounting software for freelancers in the UK because it goes beyond basic invoicing, providing a comprehensive toolkit for managing finances, staying tax-compliant with HMRC, and scaling a business. Its user-friendly interface simplifies complex tasks like bank reconciliation and expense tracking, making financial management less of a chore for creative professionals.

What sets Xero apart is its deep integration with the UK ecosystem. It offers full support for Making Tax Digital (MTD) for both VAT and the upcoming Income Tax Self Assessment (ITSA) changes. Furthermore, its vast network of UK-based accountants and a huge app marketplace allow freelancers to create a highly customised and automated financial workflow. The way that artificial intelligence in accounting is being leveraged by platforms like Xero helps streamline these processes even further.

Key Features & Pricing

Xero's plans are structured to grow with your freelance business. The entry-level "Simple" plan is specifically designed for non-VAT registered sole traders, offering core features at a lower price point.

- Pricing: Plans start from around £14 per month, but Xero frequently runs promotions offering significant discounts for the initial months. Be mindful that prices revert to standard rates after the promotional period.

- Best For: UK-based freelancers and sole traders who need a scalable, HMRC-compliant solution with strong integration capabilities. It is particularly useful for those in the construction industry requiring CIS tools.

- Pros: Excellent UK-specific features (MTD, CIS), a massive app ecosystem, and a strong network of accountants.

- Cons: The most valuable features are often locked behind more expensive plans, and promotional pricing is temporary.

Website: https://www.xero.com/uk/small-businesses/freelancers/

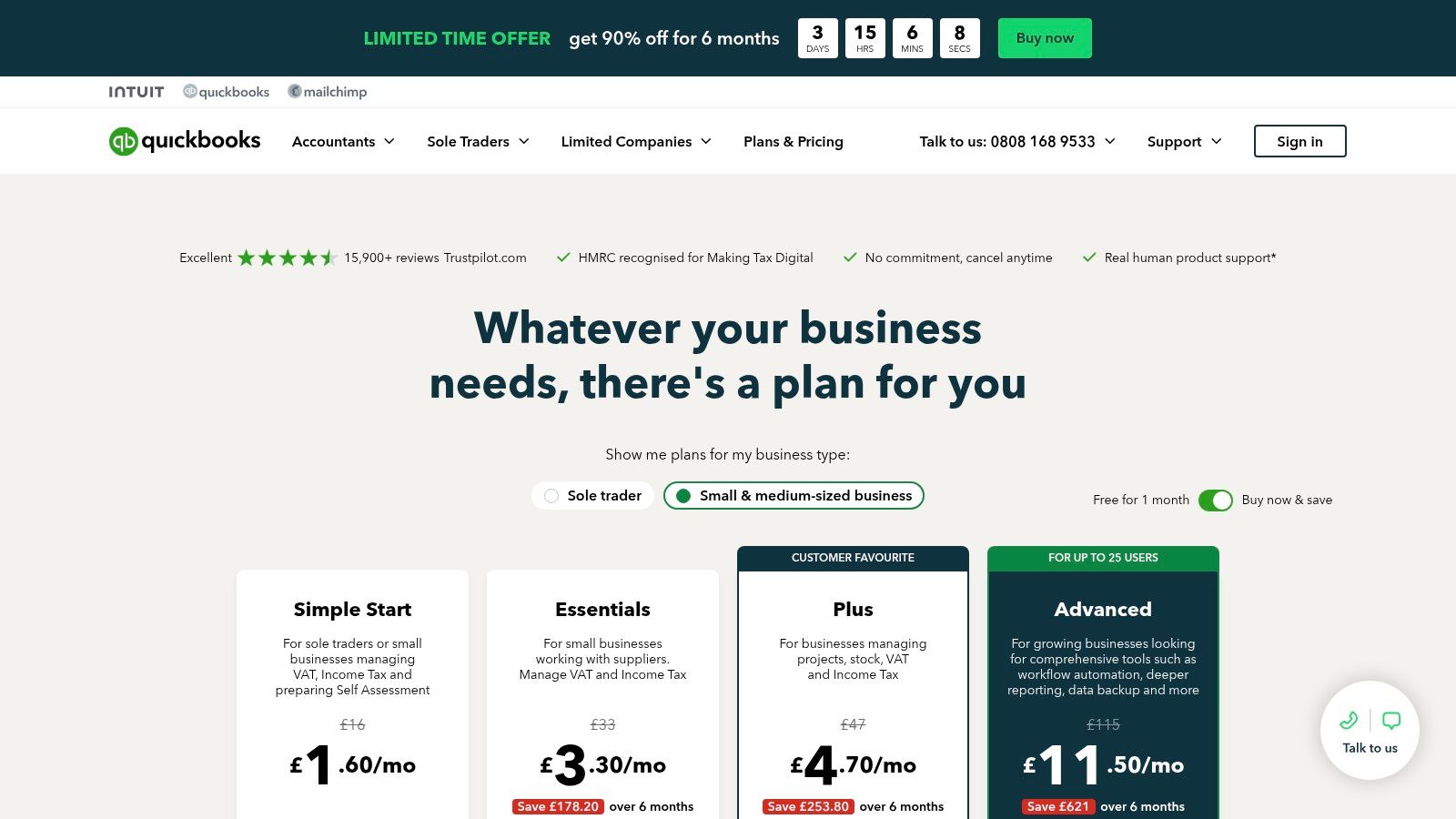

2. QuickBooks Online (UK)

QuickBooks Online is a household name in accounting software, offering a highly accessible and feature-rich platform for UK sole traders and freelancers. It stands out as one of the best accounting software for freelancers due to its tiered structure, which allows users to start simple and add complexity as their business grows. The interface is designed to be intuitive, guiding users through key tasks like creating professional invoices, tracking mileage, and preparing for Self Assessment tax returns.

What makes QuickBooks a strong contender is its robust support for UK-specific tax obligations, including full Making Tax Digital (MTD) compliance for VAT. Its ecosystem is vast, with reliable bank feeds and powerful add-ons like QuickBooks Time for freelancers who bill by the hour. The platform's strong standing also means there is a large community of UK accountants who are experts in the software, making it easier to get professional help. This widespread adoption underscores the importance of building strong defences for your accounting practice to secure sensitive financial data.

Key Features & Pricing

QuickBooks structures its plans to cater to different stages of a freelance career, from just starting out to managing more complex projects and finances. Introductory offers are very common, providing significant value for new users.

- Pricing: Plans typically start around £12 per month, but heavy introductory discounts often reduce this to a few pounds for the first six months. Always check the post-promotional rate.

- Best For: Freelancers and sole traders looking for a widely recognised, HMRC-compliant platform with scalable features and strong accountant support.

- Pros: Excellent UK brand recognition and support, a broad app ecosystem, and frequent, substantial introductory discounts for new users.

- Cons: The various plan names and promotional terms can be confusing, and crucial features like project tracking are reserved for higher-priced tiers.

Website: https://quickbooks.intuit.com/uk/pricing/

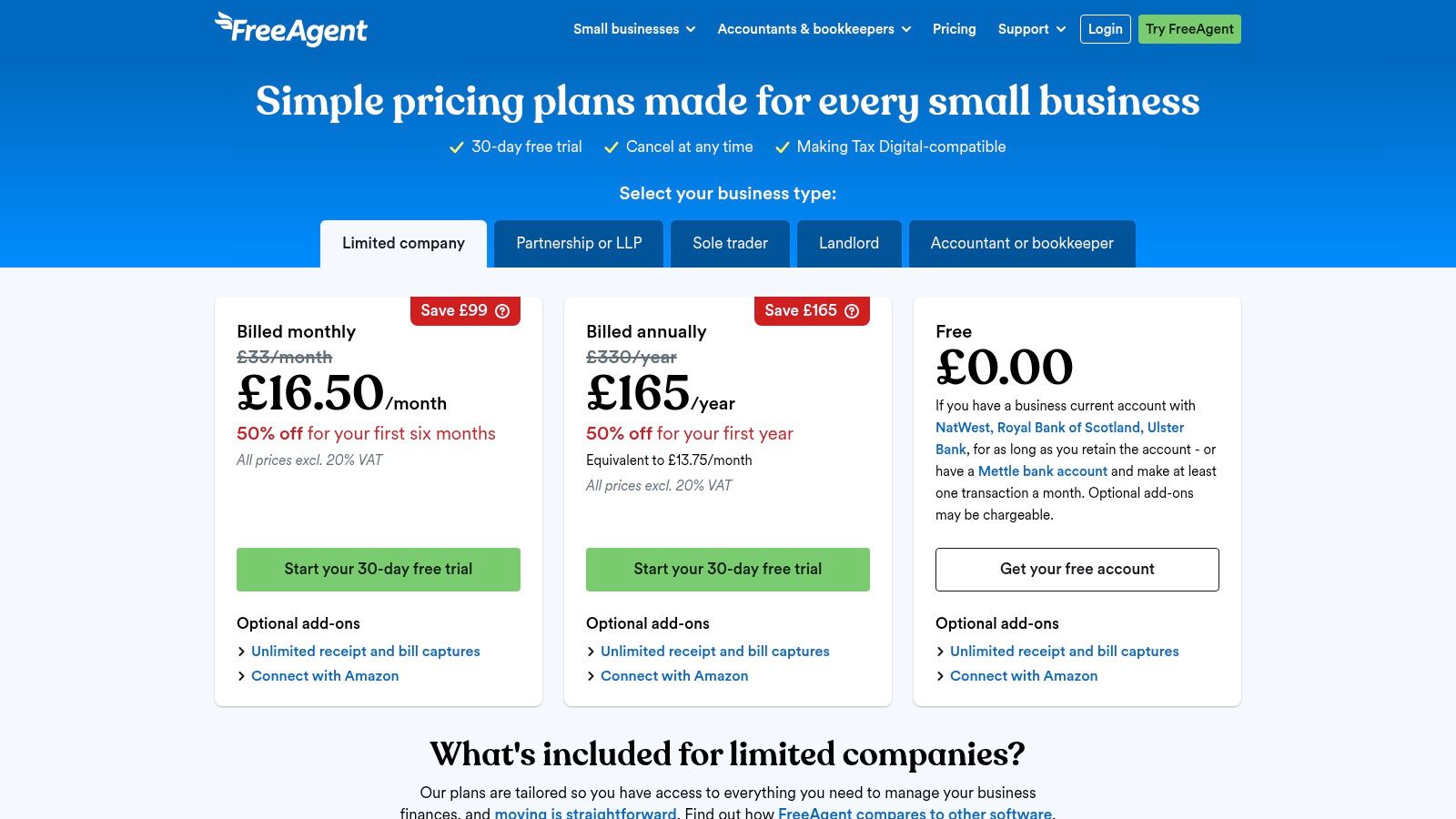

3. FreeAgent

FreeAgent is designed from the ground up for UK freelancers and micro-businesses, making it one of the best accounting software for freelancers seeking simplicity and tax compliance. It strips away complex jargon and focuses on providing a clear, intuitive dashboard that gives you a real-time overview of your finances. Its straightforward approach helps creative professionals manage invoices, track expenses, and forecast cashflow without needing an accounting degree.

What truly makes FreeAgent stand out is its deep integration with the UK banking and tax system, particularly its relationship with the NatWest Group. This partnership allows many freelancers to get the software completely free, offering immense value. The platform provides robust, MTD-compliant Self Assessment tax filing directly to HMRC, simplifying one of the most stressful parts of being self-employed. Integrating strong IT support can further enhance this, and you can learn more about boosting accounting productivity to get the most from your software.

Key Features & Pricing

FreeAgent offers a single, comprehensive plan for sole traders, which simplifies the decision-making process. The main pricing variable is whether you qualify for a free account through your business bank.

- Pricing: The "Sole Trader" plan is £19 + VAT per month, but it is completely free if you hold a business account with NatWest, Royal Bank of Scotland, Ulster Bank NI, or Mettle.

- Best For: UK-based freelancers and contractors, especially those who bank with NatWest Group and want a simple, no-fuss solution for managing finances and filing taxes.

- Pros: UK-based support and strong MTD compatibility, free indefinitely for qualifying NatWest Group/Mettle accounts, and an interface designed specifically for freelancers.

- Cons: The best value is heavily tied to banking with a NatWest Group brand, and some advanced automations or unlimited receipt capture require paid add-ons.

Website: https://www.freeagent.com/pricing/

4. Sage Accounting (Sage Business Cloud Accounting)

Sage is one of the most established names in UK business finance, and its cloud accounting platform offers a dependable and feature-rich solution for freelancers. It stands out as one of the best accounting software for freelancers by combining robust, UK-specific compliance tools with a straightforward interface. The platform is built to handle core freelance needs-from creating quotes and invoices to managing VAT returns and Construction Industry Scheme (CIS) deductions-making it a solid choice for sole traders integrated into the UK's regulatory framework.

What makes Sage a compelling option is its deep-rooted presence in the UK accounting sector, which translates to a vast network of familiar accountants and comprehensive support. Recent innovations, like the introduction of the Sage Copilot AI assistant in higher-tier plans, show a commitment to modernising workflows. This integration of AI and the support from established accountancy practices highlight how modern MSPs can alleviate digital disruption, ensuring freelancers have both advanced tools and expert backing. Its tiered structure allows freelancers to start simple and add features like multi-currency support as they grow.

Key Features & Pricing

Sage's pricing model is often highly attractive at the outset, with significant introductory discounts making it accessible. However, it's crucial to note that core features like unlimited receipt capture are reserved for higher plans.

- Pricing: Plans frequently start with deep discounts, such as 90% off for the first few months, before reverting to standard rates from around £14 per month.

- Best For: UK freelancers, particularly those in construction (CIS) or who are VAT-registered and want a familiar, trusted platform with a strong accountant network.

- Pros: Established UK brand with excellent accountant integration, comprehensive compliance tools (MTD VAT, CIS), and very appealing introductory offers.

- Cons: Key features and unlimited receipt capture are often restricted to more expensive plans, and standard pricing is less competitive than promotional rates.

Website: https://www.sage.com/master/sage-business-cloud/sage-accounting/

5. Zoho Books (UK edition)

Zoho Books offers a surprisingly feature-rich accounting suite, making a strong case as one of the best accounting software for freelancers in the UK, especially for those just starting out. It provides a comprehensive set of tools covering invoicing, expense tracking, and bank reconciliation within an intuitive interface. Its UK-specific edition is fully prepared for HMRC's Making Tax Digital (MTD) for VAT and is geared up for future MTD for ITSA requirements.

What truly makes Zoho Books stand out is its incredibly generous free plan, tailored specifically for UK businesses with an annual turnover below a certain threshold. Unlike free tiers from other providers that often feel restrictive, Zoho’s offering is robust enough to manage the core finances of a new freelance venture without an initial subscription cost. This allows freelancers to professionalise their accounting from day one, with a clear and affordable upgrade path as their business grows.

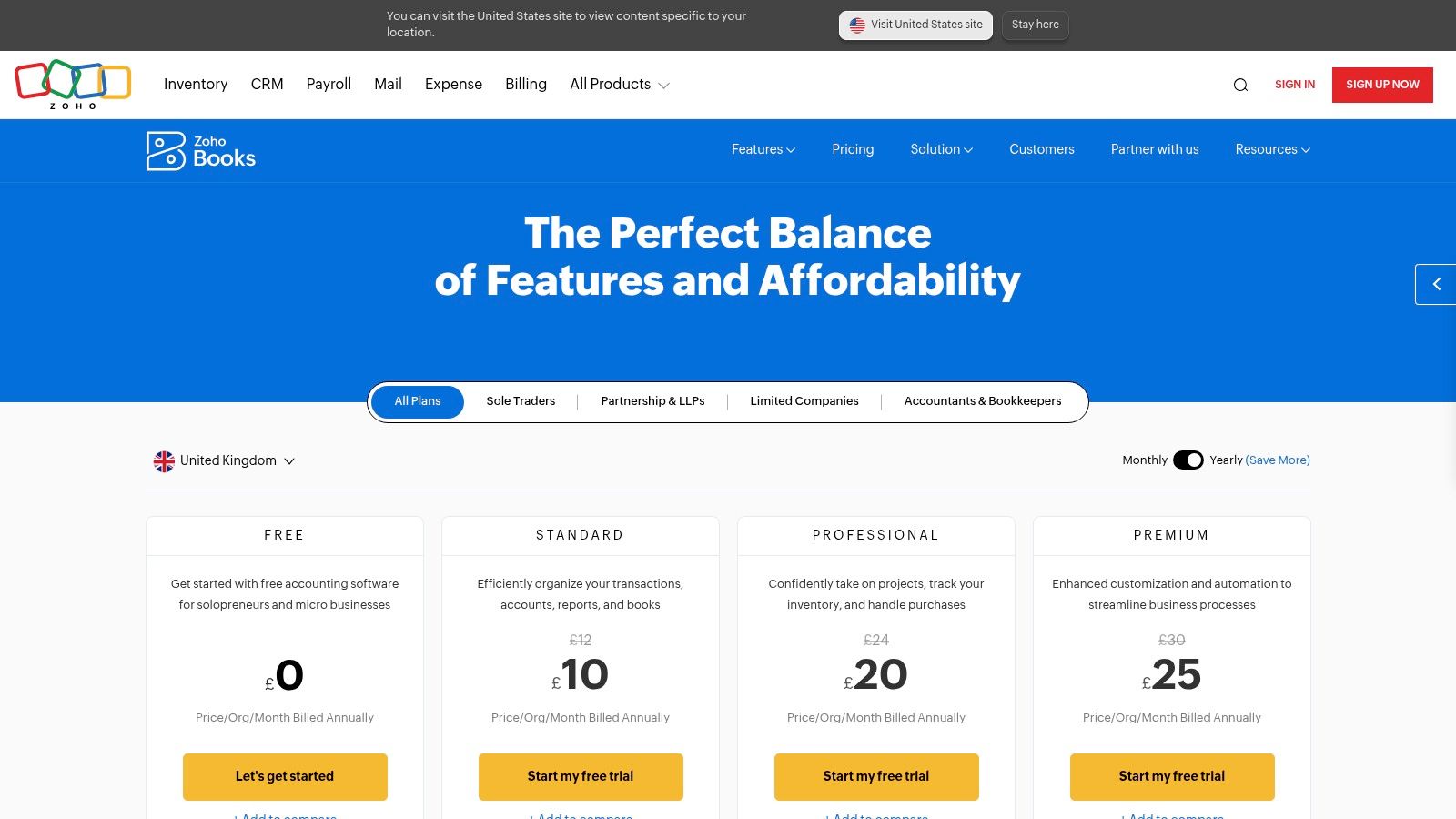

Key Features & Pricing

Zoho Books’ tiered structure ensures that you only pay for the features you need, providing exceptional value at each level. The free plan is a significant draw for sole traders testing the waters.

- Pricing: A permanent free plan is available for UK businesses with revenue under £35k per annum. Paid plans with more advanced features like bank feeds and project time tracking start from just £12 per month.

- Best For: New UK freelancers and sole traders who need a powerful, MTD-compliant accounting tool without the immediate financial commitment. It's also great for those already using other Zoho products.

- Pros: Outstanding free plan for eligible UK businesses, highly competitive pricing for paid tiers, and a comprehensive feature set that grows with your needs.

- Cons: The cost can increase if you need to add extra users or use specific add-ons, and some advanced automation tools are reserved for higher-tier plans.

Website: https://www.zoho.com/uk/books/pricing/

6. FreshBooks

FreshBooks has built its reputation on an incredibly user-friendly approach, making it one of the best accounting software for freelancers who prioritise simplicity and a great client experience. It excels at the core tasks that creatives and service-based professionals deal with daily: creating professional invoices, tracking time against projects, and capturing expenses on the move. Its clean interface ensures that even those with no accounting background can manage their finances with confidence.

What makes FreshBooks stand out is its laser focus on the freelancer's workflow, particularly around getting paid. Features like payment reminders, online payments via Stripe and PayPal, and a client portal where customers can view and pay invoices streamline the entire process. While it supports UK-specific needs like VAT, its deeper bookkeeping and tax reporting capabilities are not as comprehensive as some UK-first competitors, positioning it as a powerful invoicing tool with solid accounting features rather than a full-blown tax-filing solution.

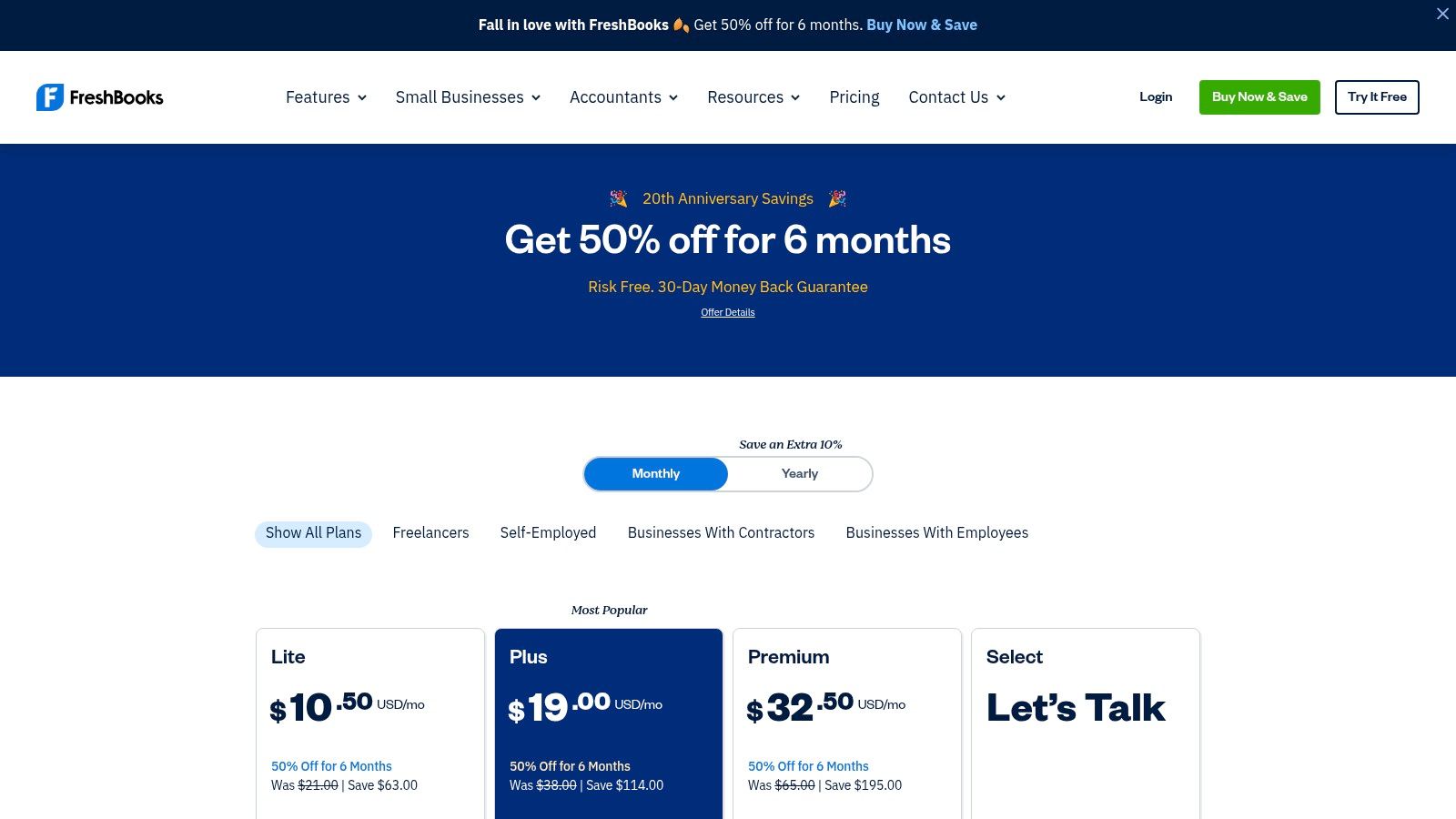

Key Features & Pricing

FreshBooks' plans are designed to be accessible, though freelancers should note the client limits on the lower-cost tiers, which can necessitate an upgrade as your business grows.

- Pricing: Plans start from £11 per month, with frequent promotions offering substantial discounts (e.g., 50% off) for the first several months. Adding team members incurs extra costs.

- Best For: Creative freelancers, consultants, and small agencies who need excellent invoicing, time-tracking, and a polished client experience without complex accounting features.

- Pros: Very easy to use with a focus on getting paid quickly, strong mobile apps for managing finances on the go, and an excellent client-facing portal.

- Cons: Lower-tier plans limit the number of billable clients, and its accounting features are less robust than UK-specific rivals like Xero or FreeAgent.

Website: https://www.freshbooks.com/en-gb/pricing

7. Pandle

Pandle is a UK-focused bookkeeping platform that carves out its niche by offering a genuinely free, permanent tier alongside an ultra-low-cost Pro plan. This makes it one of the best accounting software for freelancers who are just starting out or are extremely budget-conscious. It strips back the complexity found in more comprehensive systems, providing a clean, straightforward interface for managing core financial tasks like invoicing and tracking expenses without an initial financial commitment.

What makes Pandle stand out is its commitment to accessibility; the free plan isn’t a temporary trial but a functional, MTD-compliant tool that even allows you to file VAT returns. Unlike many competitors that charge per user, Pandle offers unlimited users on both its free and paid tiers, a significant perk for freelancers who collaborate with a bookkeeper. While its partner ecosystem is smaller, its direct, no-frills approach to bookkeeping is a refreshing alternative for those who don't need extensive integrations.

Key Features & Pricing

Pandle’s pricing model is its biggest draw, offering a clear path from basic free bookkeeping to more advanced features without a steep price jump.

- Pricing: The "Pandle Free" plan is genuinely £0 forever. The "Pandle Pro" plan, which adds bank feeds, cash flow forecasting, and mileage tracking, is priced very competitively at around £5 + VAT per month.

- Best For: New freelancers, sole traders, and small limited companies in the UK who need essential, HMRC-compliant bookkeeping tools on a tight budget.

- Pros: Extremely cost-effective with a permanent free plan, no user limits, and a simple setup process for core accounting needs.

- Cons: Key automation features like bank feeds are locked behind the Pro plan, and it has a much smaller app ecosystem than larger rivals.

Website: https://www.pandle.com/pricing/

8. QuickFile

QuickFile is a UK-built accounting platform that stands out with its genuinely free offering for smaller freelancers and sole traders. It provides a comprehensive, HMRC-compliant toolkit without the immediate monthly subscription cost associated with larger brands. This makes it one of the best accounting software for freelancers just starting out or those with a low volume of transactions who still need professional features like branded invoicing and banking automation.

What makes QuickFile particularly appealing is its transparent and fair pricing model. The free tier is not a time-limited trial; it’s free for accounts with under 1,000 nominal ledger entries per year. This allows a freelancer to manage their finances professionally from day one. It fully supports MTD for VAT and provides tools for CIS, all backed by a strong community forum and UK-based support, ensuring freelancers can navigate their tax obligations confidently.

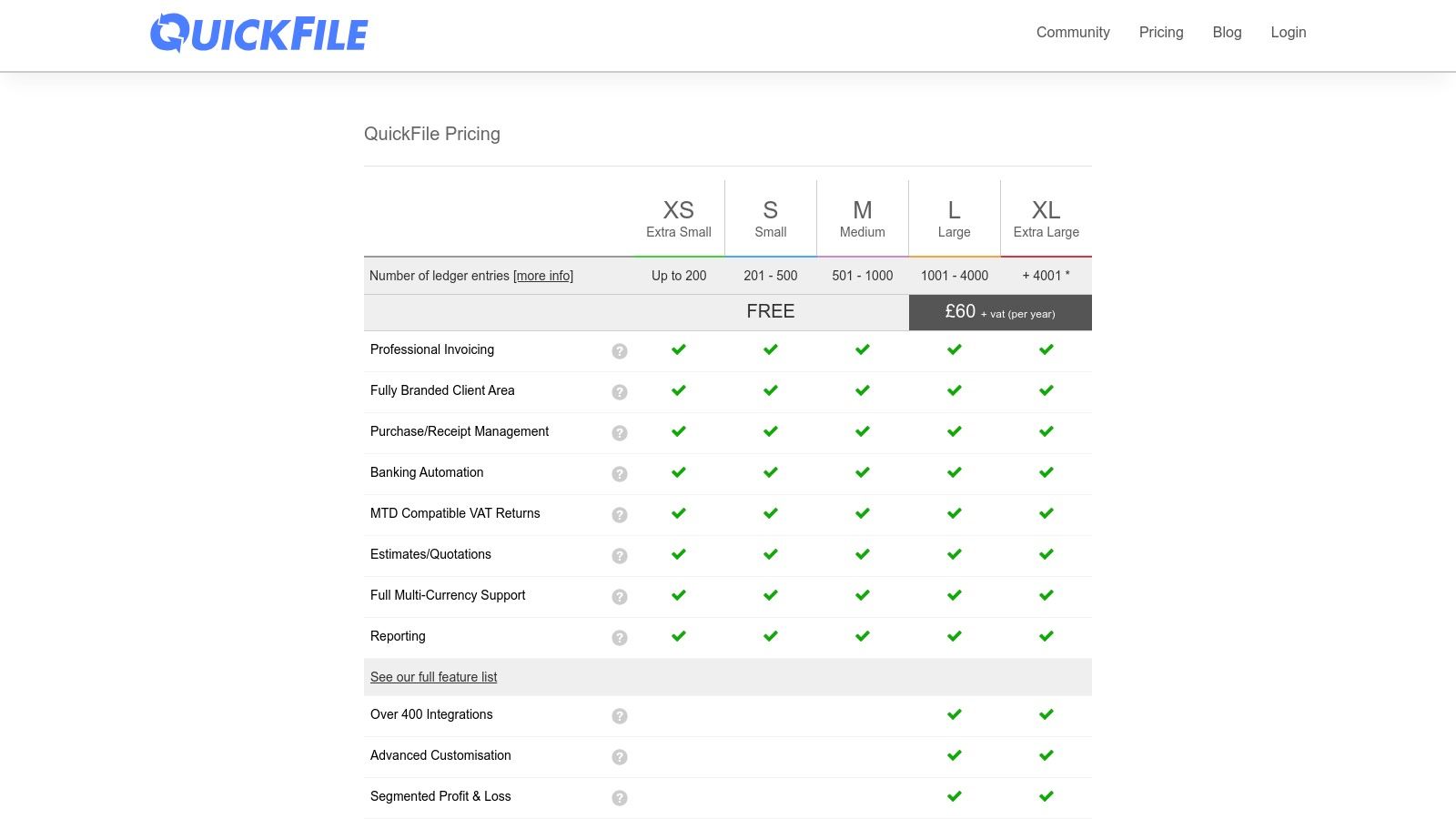

Key Features & Pricing

QuickFile’s model is built on providing core accounting features for free, with a simple, affordable annual subscription required only when a business grows beyond the free usage threshold.

- Pricing: Free for up to 1,000 nominal ledger entries annually. The Power User subscription is a flat annual fee of £60 + VAT for larger accounts. Optional add-ons like bank feeds are available at a low cost.

- Best For: UK-based freelancers, start-ups, and sole traders who want a cost-effective, no-nonsense accounting solution that can scale with them.

- Pros: Genuinely free tier for smaller users, predictable annual pricing, strong UK-specific features, and an active community forum for support.

- Cons: The user interface is less polished than premium competitors, and the Power User subscription is required once the free usage limit is exceeded.

Website: https://www.quickfile.co.uk/home/pricing

9. IRIS KashFlow

IRIS KashFlow presents itself as a straightforward, UK-focused cloud accounting platform ideal for sole traders and contractors just starting. As a long-standing provider, it offers a reliable and easy-to-navigate system for managing core financial tasks. It's considered one of the best accounting software for freelancers who want essential features like invoicing, expense tracking, and HMRC-compliant VAT filing without the complexity of more expansive systems. Its simplicity is its core strength, allowing creative freelancers to get up and running quickly.

What makes KashFlow stand out is its position within the wider IRIS ecosystem, a trusted name in UK accountancy. While it functions perfectly as a standalone tool, it offers a clear upgrade path for businesses that expect to grow and require more sophisticated payroll or HR tools in the future. The platform is specifically designed for the UK market, ensuring full compliance with Making Tax Digital and simplifying the process of submitting VAT returns directly to HMRC from the software.

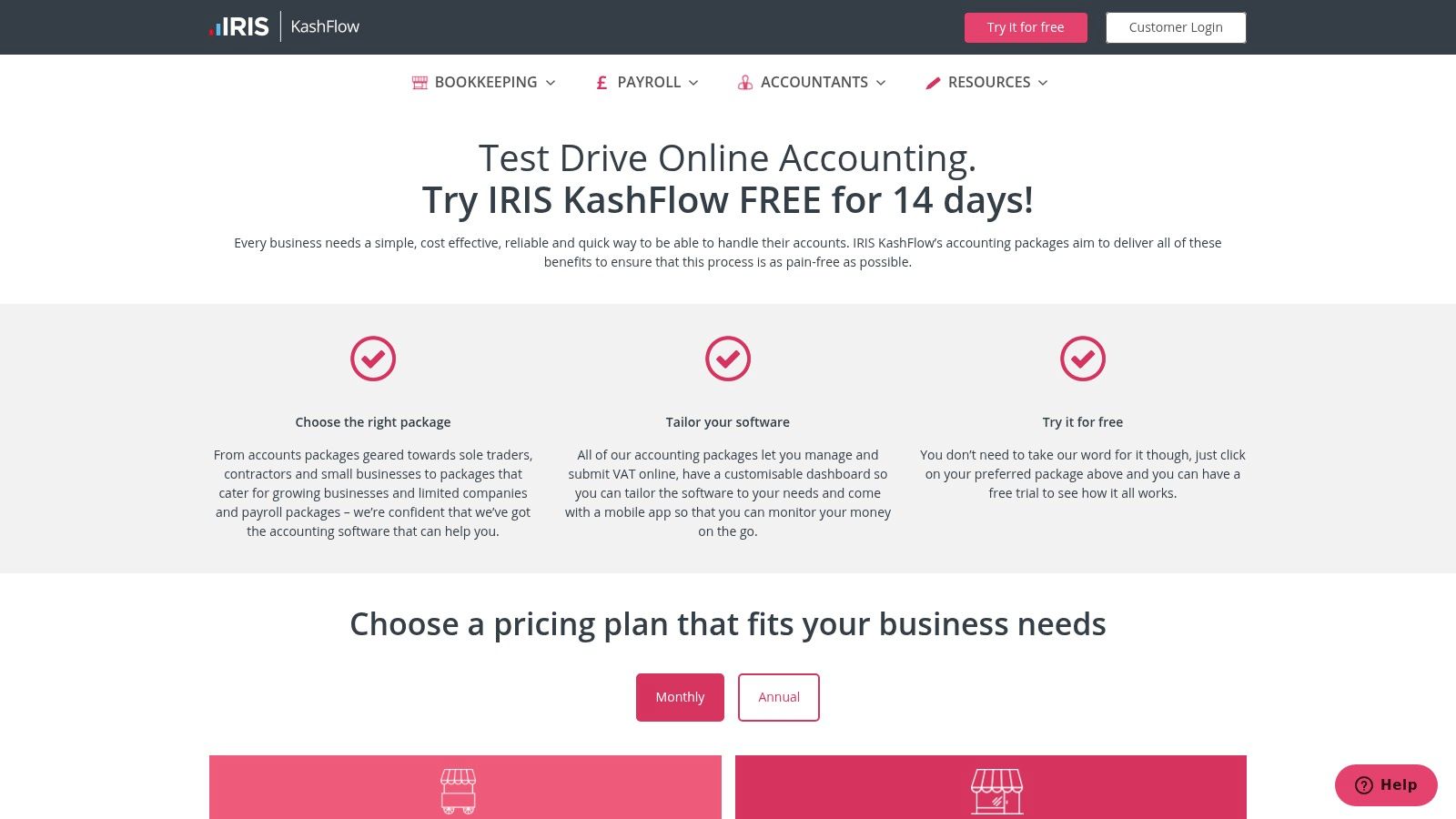

Key Features & Pricing

KashFlow’s pricing is structured to be highly accessible, with its entry-level plan covering all the fundamentals a new freelancer needs. The frequent and deep introductory discounts make it a very low-cost entry point into proper business accounting.

- Pricing: The Starter plan often has promotional pricing around £9 per month (+VAT), with standard pricing resuming after the initial period. Higher tiers add payroll and CIS features.

- Best For: UK-based sole traders and small limited companies who need a simple, no-fuss, and affordable solution for core accounting and tax compliance.

- Pros: Very user-friendly for beginners, strong introductory discounts make it highly affordable, and it's backed by a reputable UK accounting software provider.

- Cons: The interface and feature set are less modern than competitors, and the app ecosystem is significantly smaller than those of Xero or QuickBooks.

Website: https://www.kashflow.com/pricing/

10. Coconut

Coconut is a mobile-first accounting and tax app designed from the ground up for UK sole traders and self-employed individuals. It strips away the complexity found in larger SME-focused platforms, offering a streamlined solution that combines bookkeeping with powerful tax estimation. For freelancers who want a simple, on-the-go tool to track income, categorise expenses, and understand their tax position in real-time, Coconut is one of the best accounting software for freelancers available.

What makes Coconut stand out is its laser focus on the sole trader journey. It connects directly to over 30 UK bank accounts, automatically categorising transactions and updating your tax savings pot as you earn. This clear, continuous visibility into upcoming tax bills helps freelancers avoid nasty surprises and manage their cash flow more effectively. The platform is also gearing up for HMRC’s Making Tax Digital for Income Tax Self Assessment (MTD for ITSA), ensuring users are prepared for the transition.

Key Features & Pricing

Coconut's pricing is straightforward, reflecting its simple-to-use philosophy. It offers a plan tailored specifically to the needs of individual self-employed professionals without unnecessary features.

- Pricing: The "Side Hustle" plan is free, offering basic invoice and expense tracking. The full-featured "Sole Trader" plan is around £7.50 per month (paid annually), providing bank connections, tax estimates, and MTD support.

- Best For: UK-based sole traders, side hustlers, and freelancers who prioritise simplicity, mobile access, and clear, real-time tax estimation over complex features.

- Pros: Extremely easy to set up and use, excellent UK tax focus with clear estimations, and an affordable, transparent pricing model.

- Cons: Not suitable for limited companies or businesses with complex accounting needs, and its feature set is much smaller than comprehensive accounting suites.

Website: https://www.getcoconut.com/pricing

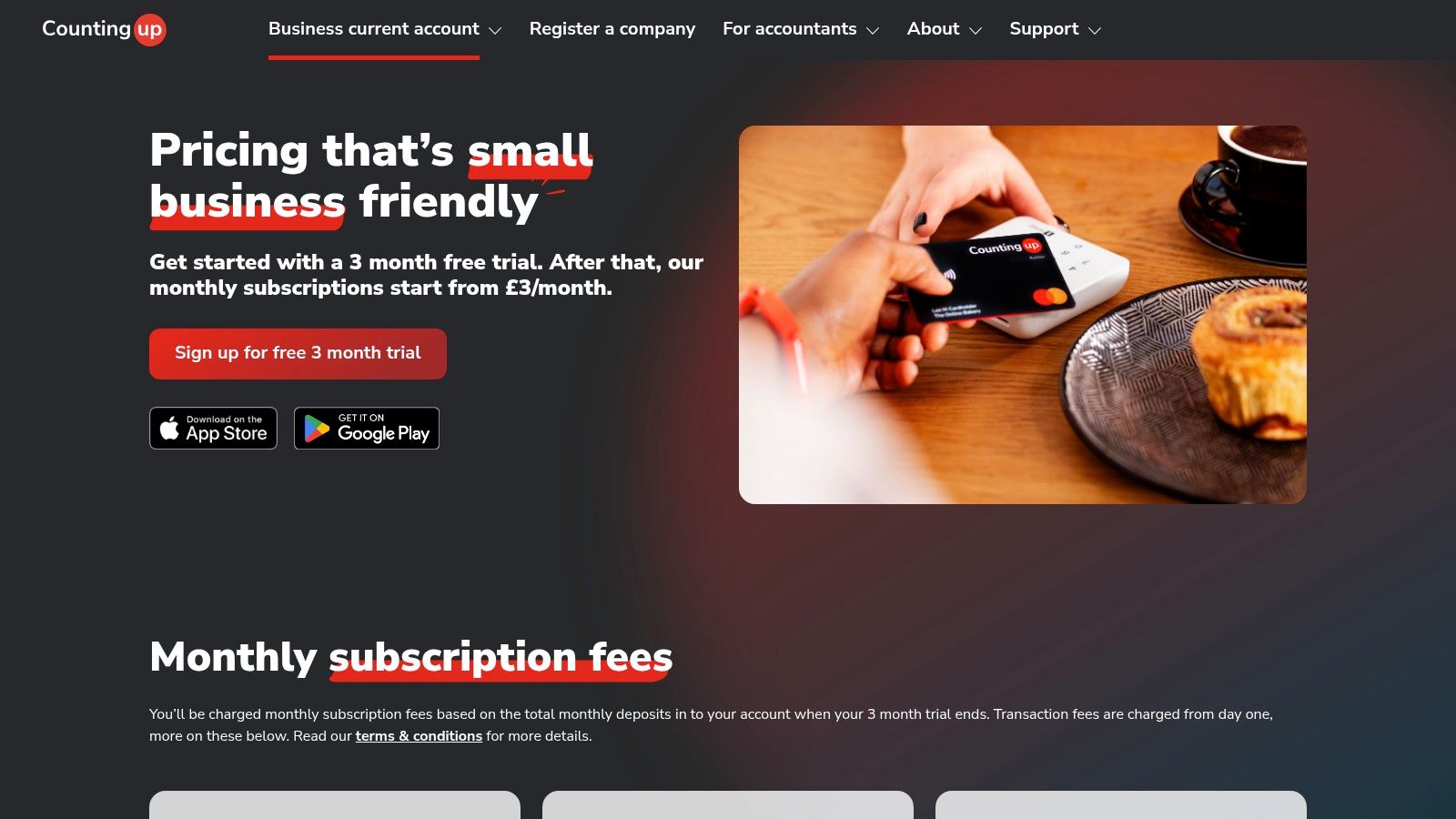

11. Countingup

Countingup merges a UK business current account with accounting software into a single, streamlined app. This all-in-one approach makes it one of the best accounting software for freelancers who want to simplify their financial admin by combining banking and bookkeeping. The platform automates tedious tasks by providing a business debit Mastercard that automatically categorises transactions as they happen, eliminating the need for manual data entry and reconciliation between separate bank and accounting systems.

What makes Countingup stand out is its real-time financial overview. By having banking and accounting integrated, it can offer live tax estimates and create a dedicated "tax pot" to set aside funds, helping sole traders avoid nasty surprises when their self-assessment is due. It also features built-in invoicing, receipt capture, and MTD VAT filing, providing a complete financial management tool directly from your smartphone. This integrated system is ideal for freelancers who value simplicity and want to see their business's financial health at a glance.

Key Features & Pricing

Countingup's pricing is unique as it's tied to your monthly deposit volume, making it scalable for businesses as they grow.

- Pricing: Plans start from £3 per month for deposits up to £750, rising based on monthly income. Be aware that transaction fees also apply for certain activities like bank transfers and cash deposits.

- Best For: UK-based sole traders and small limited companies who want the convenience of a combined business account and accounting tool to save time and reduce complexity.

- Pros: All-in-one banking and bookkeeping simplifies admin, real-time tax estimates are incredibly useful for planning, and the mobile-first design is very user-friendly.

- Cons: The usage-based pricing model and additional transaction fees can become costly for high-turnover businesses, and it’s not suitable if you prefer to keep your banking and accounting separate.

Website: https://countingup.com/small-businesses/pricing/

12. Tide Accounting

Tide Accounting offers a highly integrated solution for freelancers already using or considering a Tide business bank account. It’s positioned as a simple, affordable add-on rather than a standalone behemoth, making it one of the best accounting software for freelancers who prioritise convenience and a unified financial dashboard. Its primary strength lies in its seamless connection to Tide banking, which automates transaction categorisation and streamlines financial admin directly within one app.

What makes Tide Accounting a compelling choice is its direct mapping of bank transactions to the categories required for a Self Assessment tax return (SA103 form). This significantly simplifies the year-end process for sole traders. While it may not have the expansive feature set of a dedicated platform like Xero, it covers the essentials-like VAT return submission and invoicing-with remarkable efficiency for those whose needs are straightforward.

Key Features & Pricing

Tide bundles its accounting feature as a low-cost add-on to its business bank account, which is free. This pricing model is attractive for freelancers looking to control overheads.

- Pricing: The accounting add-on is available for a low, fixed monthly fee. Bundles that include the Invoice Assistant and Admin Extra options are also available for enhanced functionality.

- Best For: UK-based sole traders and small limited companies who are already Tide banking customers and need a simple, integrated system for managing tax and invoicing.

- Pros: Seamless integration with Tide business accounts, very low fixed monthly price, and simplified workflows designed for UK sole trader tax returns.

- Cons: Feature set is much narrower than full accounting suites, and it does not support certain tax schemes like the Flat Rate VAT scheme.

Website: https://www.tide.co/accounting-software/

Top 12 Freelancer Accounting Software Comparison

| Product | Key features | UX & rating | Price & value | Target & USP |

|---|---|---|---|---|

| Xero (UK) | ✨ MTD VAT/ITSA, bank feeds, Hubdoc, CIS tools | ★★★★ · polished, large partner network | 💰 Medium – Simple plan for sole traders + promos | 👥 Freelancers & accountants · 🏆 Extensive UK app & adviser ecosystem |

| QuickBooks Online (UK) | ✨ MTD VAT, invoicing, time tracking add‑on | ★★★★ · widely recognised, strong support | 💰 Medium – frequent intro discounts, reseller deals | 👥 Small firms & accountants · 🏆 Broad ecosystem & discounts |

| FreeAgent | ✨ Jargon‑free UK tax focus, cashflow forecasting | ★★★★ · simple UX, UK‑first support | 💰 Low–Medium – free for many NatWest customers | 👥 Freelancers & contractors · 🏆 Built for UK sole traders |

| Sage Accounting | ✨ MTD/CIS, receipt capture, Sage Copilot (tiers) | ★★★★ · established brand, tiered features | 💰 Medium–High – heavy promos but features tiered | 👥 SMEs & accountants · 🏆 Longstanding UK presence & compliance tools |

| Zoho Books (UK) | ✨ MTD filing, invoicing, expenses, free tier | ★★★★ · feature‑rich for price | 💰 Low – generous free plan + affordable tiers | 👥 Very small businesses scaling up · 🏆 Strong value for cost |

| FreshBooks | ✨ Invoicing, time tracking, mobile apps | ★★★ · very easy to use, great mobile UX | 💰 Low–Medium – promo pricing common | 👥 Freelancers & service pros · 🏆 Excellent client experience & mobile |

| Pandle | ✨ Permanent free tier, unlimited users | ★★★ · lightweight, quick setup | 💰 Very low – free + ultra‑cheap Pro | 👥 Budget‑conscious freelancers · 🏆 Cost‑effective bookkeeping |

| QuickFile | ✨ Free tier up to 1,000 entries, API & add‑ons | ★★★ · functional but less polished UI | 💰 Very low – truly free up to limit, clear add‑ons | 👥 Micro businesses & hobbyists · 🏆 Transparent pricing & community |

| IRIS KashFlow | ✨ VAT filing, bank feeds, mobile app | ★★★ · reliable starter option | 💰 Low–Medium – frequent sign‑up promos | 👥 Sole traders & contractors · 🏆 Established vendor reliability |

| Coconut | ✨ Auto‑categorisation, tax estimates, MTD ITSA | ★★★★ · very simple, fast onboarding | 💰 Low – sole‑trader focused pricing | 👥 Sole traders/self‑employed · 🏆 Clear tax guidance & FCA authorised |

| Countingup | ✨ Business bank + bookkeeping, tax pots | ★★★ · all‑in‑one banking & accounts | 💰 Low–Medium – usage‑based tiers & fees | 👥 Freelancers wanting banking+accounts · 🏆 Integrated banking experience |

| Tide Accounting | ✨ Transaction mapping, VAT submission (non‑FR) | ★★★ · seamless for Tide customers | 💰 Low – add‑on pricing for Tide accounts | 👥 Tide bank users & sole traders · 🏆 Tight banking integration |

Choosing the Right Financial Partner for Your Freelance Work

Navigating the extensive list of the best accounting software for freelancers can feel overwhelming, but the journey ends with a powerful tool that will become the financial backbone of your independent career. As we have explored, the ideal solution is not a universal one-size-fits-all platform. Instead, it is the one that aligns most closely with your specific business stage, technical comfort, and long-term growth aspirations. The key is to move beyond marketing claims and focus on how a platform will integrate into your daily operations.

Your selection process should be a strategic one. Rather than being swayed by the longest feature list, consider the core functionalities you will use every day. For a freelance designer just starting, a streamlined, user-friendly interface for sending invoices and tracking a handful of expenses, like that offered by FreeAgent or FreshBooks, might be far more valuable than the multi-layered complexity of an enterprise-level system. Conversely, a seasoned consultant managing multiple projects and VAT returns will find the robust reporting and accountant-friendly features of Xero or QuickBooks Online indispensable for maintaining financial clarity and compliance.

Making a Decision Based on Your Freelance Persona

To simplify your choice, think about where you currently stand in your freelance journey.

- The Newcomer: If you are just launching your business, minimising overheads is crucial. Platforms like Pandle and QuickFile offer powerful free tiers that cover the essentials-invoicing, expense tracking, and basic reporting-without any initial financial commitment. This allows you to establish good financial habits from day one without straining your budget.

- The Efficiency-Seeker: For freelancers who want to spend less time on admin and more time on billable work, an all-in-one solution is a game-changer. The integrated business bank accounts and automated bookkeeping offered by neobanks like Coconut and Countingup significantly reduce manual data entry, providing a real-time, accurate view of your finances with minimal effort.

- The Growth-Focused Professional: If your freelance business is scaling, you need software that can grow with you. Sage Accounting and Zoho Books provide a clear upgrade path, with tiered plans that introduce advanced features like project management, multi-currency support, and comprehensive inventory tracking as your needs evolve. This scalability prevents the future disruption of migrating to a new system.

Final Considerations Before You Commit

Before you finalise your choice, take full advantage of the free trials offered by nearly every provider on our list. This is your opportunity to conduct a hands-on evaluation. Can you easily create and customise an invoice? Is the process for logging a business expense intuitive? Connect your bank account to test the feed's reliability. This trial period is the single best way to determine if a platform’s workflow feels natural to you.

Remember, managing your business's finances extends beyond just tracking income and expenses. A holistic approach to your financial health is vital for long-term stability and peace of mind. As a self-employed professional, you are responsible for your entire benefits package, so it is wise to proactively plan for all eventualities. Beyond your accounting software, it's essential to research and understand your options for self-employment health insurance to ensure you are protected against unexpected medical costs.

Ultimately, the best accounting software for freelancers is the one you will consistently use. It should feel less like a chore and more like a dependable business partner, empowering you to make informed decisions, stay compliant, and focus on what you do best-delivering exceptional work for your clients.

As you integrate powerful software into your freelance operations, ensuring the security and performance of your digital tools is paramount. For creative professionals who rely on technology, InfraZen Ltd provides strategic, outsourced IT support and management. We ensure your systems-including the device running your crucial accounting software-are secure, efficient, and reliable, so you can focus on your creative work without worrying about tech issues.