Getting paid on time is everything for a small business. That’s where dedicated free invoice software for small business comes in. It automates the whole invoicing headache-from creating the bill to tracking the payment-so you get paid faster, make fewer mistakes, and look more professional.

Why Your Business Needs Free Invoicing Software

Let’s be honest, managing invoices manually is more than just tedious-it’s a massive drain on your time and money. For many UK small business owners, the day-to-day is a battle with spreadsheets, chasing late payers, and worrying that one tiny mistake could throw off your cash flow. This old-school approach isn't just inefficient; it's risky.

Switching to free invoice software isn't just a tech upgrade; it's a strategic move to shore up your finances. Think of it as laying a stronger foundation for your business. Instead of typing everything out by hand, where one small typo can lead to payment delays, these tools do the heavy lifting for you.

Stop Chasing Paperwork and Start Improving Profits

A slick invoicing process does more than just claw back a few hours each week. It has a direct impact on your bottom line and your client relationships. Automated systems catch common errors, speed up payment times, and help you maintain a polished, professional image with every interaction.

The benefits are clear and almost immediate:

- Reduced Admin Overload: Automating repetitive jobs frees you up to focus on growing the business, not drowning in paperwork.

- Faster Payments: Professional invoices with clear, clickable payment links get paid quicker. It’s that simple, and it makes a huge difference to your cash flow.

- Enhanced Professionalism: Sending consistently branded, accurate invoices builds trust and credibility with your clients.

- Simplified Compliance: Many tools are built to help you stay compliant with UK regulations, like Making Tax Digital (MTD) for VAT-registered businesses.

By automating billing and reminders, you eliminate the awkwardness of chasing payments. This helps you maintain positive client relationships while ensuring a steady and predictable revenue stream, which is vital for long-term growth.

Ultimately, these tools are just one part of a wider set of technologies that can help you run your small business better by smoothing out the operational bumps. It’s time to step away from manual processes and embrace a solution that actively supports your financial health and professional reputation.

How Free Invoicing Tools Simplify Your Workflow

Think of free invoice software for small business as your automated financial assistant-one that works around the clock without ever needing a tea break. It’s a command centre that creates, sends, tracks, and even reminds clients about payments, all without you having to constantly poke and prod it. This gets you out of the weeds of admin so you can focus on the work you actually enjoy.

At its heart, this kind of software is designed to be dead simple. You don't need to be a tech wizard to get started. The entire point is to take a manual, error-prone process and make it fast, professional, and reliable.

Automating Your Financial Operations

The real magic of these tools is automation. They handle all the repetitive tasks that eat up your day, making sure every invoice you send is consistent and accurate. This methodical approach slashes the chance of human error-like forgetting to add VAT or mistyping a due date-which has a direct knock-on effect on how quickly you get paid.

Here are the key functions that make it all click into place:

- Cloud-Based Access: Need to create an invoice on the go? No problem. You can send and check the status of your invoices from anywhere, on any device. Your financial data is always right there with you, not trapped on a single computer back at the office.

- Automated Payment Reminders: The software can be set up to send polite follow-up emails for overdue invoices automatically. This gets rid of those awkward chase-up calls and helps you keep a great relationship with your clients while still making sure you get paid.

- Payment Gateway Integrations: By linking up with platforms like Stripe or PayPal, these tools let clients pay you with a single click. It's been shown that offering multiple ways to pay can get cash in your bank account significantly faster.

These platforms are built to help you manage your money with the same professional polish as a big corporation. They level the playing field, giving you access to tools that used to be expensive and complicated.

If you want to dig deeper into modern digital billing, this a complete guide to e-invoicing for business is a great resource that explores its impact on financial workflows. On a similar note, understanding how different tech tools for creatives simplify workflows can offer a broader view on boosting efficiency. Ultimately, switching to free invoicing software is a simple but powerful step towards a more organised and profitable business.

Key Features of Top Free Invoice Software

Let's be honest, not all free invoice software is created equal. While they all send invoices, the best tools do so much more-they actually help you run your business better, look more professional, and keep your cash flow healthy. Knowing what to look for is the key to picking a tool that’s a genuine asset, not just another piece of software.

Think about it: your invoice is often the last thing a client sees. That's why customisable templates are non-negotiable. Good free software lets you pop your logo in, use your brand colours, and tweak the layout. It's about sending out polished, consistent documents that build trust every single time.

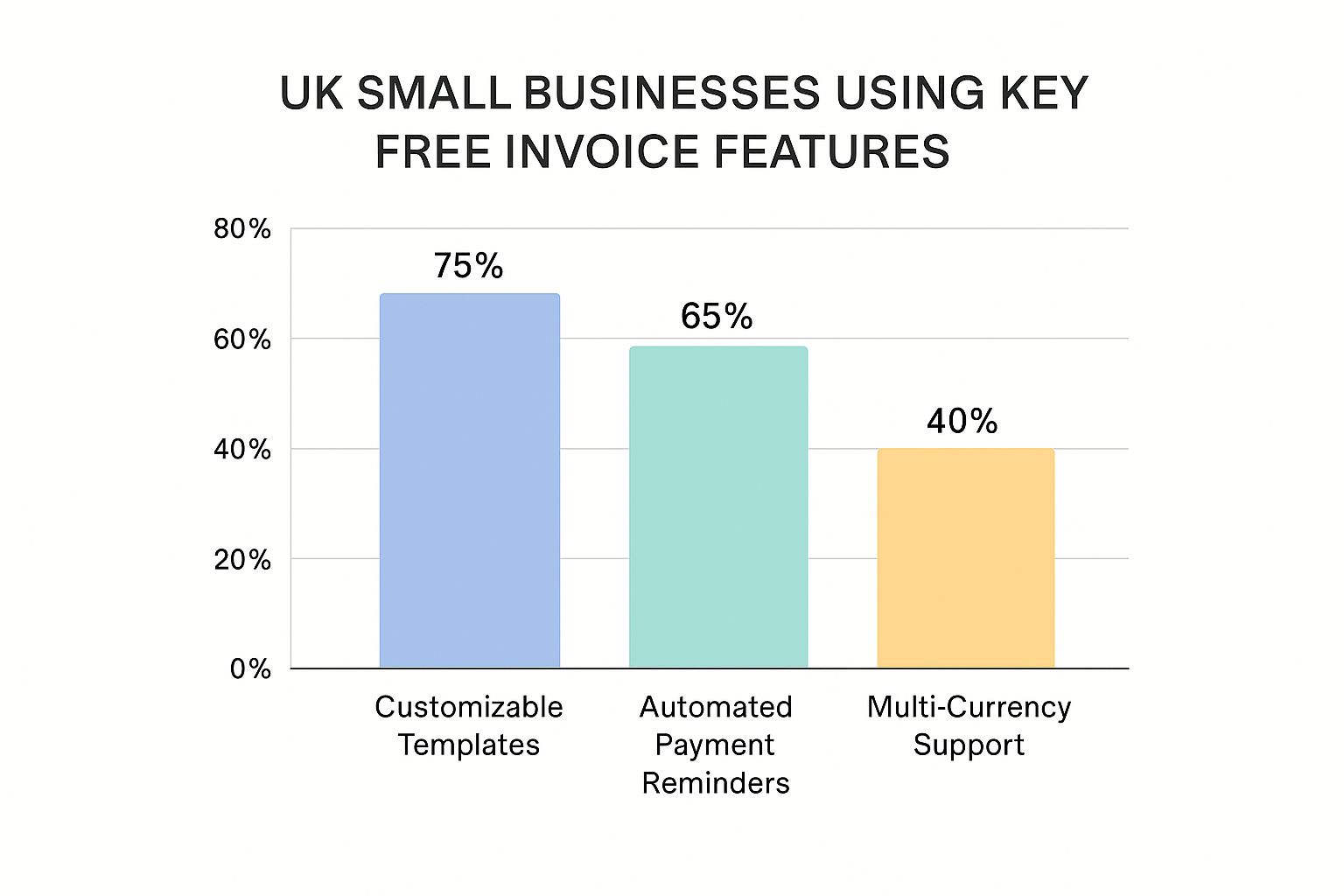

This infographic shows just how much UK small businesses value these kinds of features.

It's clear that business owners are focused on tools that save them time and make them look good. Branding and automation aren't just nice-to-haves; they're top priorities.

Automating for Better Cash Flow

Chasing late payments is a soul-destroying task for any business owner. That's where automatic payment reminders come in. You can set up the software to send a polite nudge when an invoice is nearly due or has just tipped over, helping you get paid faster without having to play bad cop.

Think of these features as your digital toolkit for financial efficiency. Each one solves a specific problem-from inconsistent branding and late payments to messy expense claims and complex tax rules-allowing you to run your business more smoothly.

Another game-changer is integrated expense tracking. This lets you log business purchases right inside the platform, often just by snapping a photo of a receipt with your phone. When you need to bill a client for project costs, you can add those expenses to the invoice with a click, making sure you never forget to claim back what you're owed.

Essential Features for Modern UK Businesses

As your business grows, you'll find other features become just as critical. Here's a quick look at how some of the most popular free options stack up.

Comparison of Must-Have Features in Free Invoice Software

This table breaks down how different free platforms handle the features that really matter for UK small businesses.

| Feature | Importance for Small Business | Example Software 1 | Example Software 2 | Example Software 3 |

|---|---|---|---|---|

| Customisable Templates | Crucial for maintaining a professional brand identity. | ✔️ | ✔️ | ✔️ |

| Automated Reminders | Essential for improving cash flow and reducing admin time. | ✔️ | ✔️ (Limited) | ✔️ |

| Expense Tracking | Hugely valuable for accurate project billing and tax returns. | ✔️ | ✔️ | ❌ |

| Multi-Currency Support | A must-have for businesses serving international clients. | ✔️ (Paid Add-on) | ✔️ | ✔️ |

| HMRC MTD Compliance | Non-negotiable for any VAT-registered business in the UK. | ✔️ | ✔️ | ✔️ (Paid Tier) |

| Mobile App | Important for managing invoices and expenses on the go. | ✔️ | ❌ | ✔️ |

While most free tools cover the basics, you can see how some features might be limited or only available in paid versions. Always check the fine print to make sure the "free" plan really does what you need it to.

If you work with clients overseas, multi-currency support is a lifesaver. It lets you bill them in their own currency while you track everything in pounds, making life easier for everyone.

And for any VAT-registered business in the UK, HMRC MTD compliance isn't just a feature-it's a legal requirement. The right software ensures your records are kept in a way that meets HMRC’s Making Tax Digital rules, saving you a massive headache down the line. To get a better handle on this, you can find great insights on how free platforms help with VAT and tax compliance for UK businesses.

These tools are also getting smarter all the time. To see where things are headed, you can read more about the growing role of artificial intelligence in accounting and how it's starting to handle even more of the heavy lifting.

By focusing on these key features, you're not just picking a free tool. You’re choosing a free invoice software for small business that solves today’s problems and is ready to grow with you tomorrow.

The Real-World Payoff of Automated Invoicing

Moving away from manual spreadsheets to an automated invoicing system isn't just about saving a few hours here and there. It's a fundamental shift that genuinely strengthens your cash flow, polishes your professional image, and makes sorting out your compliance duties a whole lot simpler. Using free invoice software for small business isn’t merely a convenience-it’s about building a more solid, efficient, and trustworthy business from the ground up.

The first thing you’ll notice is the impact on your cash flow. Automated systems get invoices out the door instantly and can send polite, scheduled reminders for you. This steady process keeps you top-of-mind, minus the awkwardness of personally chasing clients for payment.

Build Client Trust and Sharpen Your Reputation

A professional, consistently branded invoice does more than just ask for money. It reinforces who you are as a brand and builds a real sense of trust with your clients. When every document looks the part and is free from mistakes, it signals that you’re organised, reliable, and take your work seriously. That level of polish can easily set you apart from competitors still using generic templates.

On top of that, these systems create a perfect digital paper trail. Every invoice sent, payment received, and expense logged is recorded with precision. That clean record-keeping is worth its weight in gold.

Keeping organised digital records isn’t just good practice-it’s a must for Making Tax Digital (MTD) compliance. Clean, accessible data minimises the risk of costly errors and potential fines from HMRC, turning a major headache into a simple, automated task.

For creative businesses in particular, understanding that time is money and how to reclaim hours is key. The hours you get back from admin tasks can be poured directly into client work and growing the business.

Cut Down on Errors and Get More Done

Tapping numbers into a spreadsheet is a classic weak spot for small businesses. It’s surprising how common it still is-around 86% of UK small businesses are still manually entering invoice data. This doesn't just slow down payments; it’s an open invitation for human error. Free digital software automates this, often using smart tech to pull data correctly, ensuring accuracy and speeding up the entire billing cycle. You can find more insights on how digital tools transform invoice processing on Airwallex.com.

By embracing automation, you get several big wins all at once:

- Faster Payments: Automated nudges and simple payment links drastically cut down the time it takes to get paid.

- Better Client Relationships: Taking the awkward money conversations out of the equation helps you maintain positive, professional connections.

- Simpler Compliance: Clean, digital records make meeting HMRC's MTD rules far more straightforward.

- A More Professional Look: Consistently branded and accurate invoices build trust and elevate your reputation.

At the end of the day, the right software changes invoicing from a chore into a powerful tool for financial stability and business growth.

How to Choose the Right Invoicing Platform

Picking the best free invoice software for your small business isn't about grabbing the one with the longest feature list. It’s about finding the tool that slots perfectly into how you already work. If you don't have a clear idea of what you need, you could easily end up with a tool that creates more headaches than it solves.

So, start by looking at your own business model. Do you bill by the hour, or do you sell products? A freelance designer's needs are worlds away from a small e-commerce shop's. The designer needs to track every minute to bill clients accurately, while the shop owner is juggling inventory and probably needs to handle different currencies for international sales. Nailing down these core requirements from the get-go stops you from choosing software that just doesn't fit.

Look Beyond the Free Plan

Scalability is a huge deal. A free plan might tick all the boxes for you right now, but what about next year? What happens when your client list doubles, or you need to bring another person onto your team? You need to check out the provider's upgrade paths.

Are the paid tiers affordable? Do they offer the features you can see yourself needing in a year or two, like more integrations or deeper financial reports? Choosing a platform with a sensible, budget-friendly growth path saves you the massive pain of having to switch systems down the line.

Think of your invoicing software as a long-term business partner. Don’t just look at what it offers for free today; assess its potential to support you as you grow and your finances get more complicated. The goal is to find a future-proof solution.

Prioritise Usability and Support

Even the most powerful software is useless if it’s a nightmare to use. You want a platform with a clean, intuitive interface that makes creating and sending an invoice feel effortless. A clunky, confusing system will only slow you down and completely defeat the purpose of getting the tool in the first place.

Customer support is just as important. When something goes wrong-and at some point, it will-you need to know that help is available. See what kind of support is offered on the free plan. Is it just email, or can you get help from a knowledge base or a community forum? Knowing you have reliable support brings real peace of mind.

Finally, think about integrations. How well does the software play with the other tools you rely on every day? Smooth connections to your online bank, CRM, or payment gateways like Stripe and PayPal are non-negotiable for a slick workflow. Good integration gets rid of manual data entry, cuts down on mistakes, and gives you a much clearer picture of your financial health. When you're ready to dig deeper, a guide to the best cloud accounting software for small businesses can offer some invaluable insights.

Late payments are a constant headache for UK businesses. A recent report found that companies requiring immediate payment saw 5% sales revenue growth, while those offering 90-day terms only saw 2%. It’s proof that getting paid faster directly fuels a healthier cash flow. Discover more insights about late payments on quickbooks.intuit.com. This really drives home how important it is to choose software that helps you get paid on time.

Getting Started With Your New Invoicing System

Making the jump to a new invoicing system is a big move, but it doesn't have to be a headache. In fact, getting started with free invoice software for small business is usually a walk in the park. This guide will break down the entire setup into five simple, practical steps, taking you from a blank slate to sending out your first professional invoice.

Think of it as laying the groundwork for a more organised financial future. Each step builds on the last, making sure you have everything in place to get paid faster and more reliably.

A Five-Step Launch Sequence

Follow this quick sequence, and you'll be up and running in no time. The whole point is to spend less time bogged down in admin and more time doing what you do best.

-

Sign Up and Enter Company Details

First things first: create your account. You'll be asked for the essentials-your company name, address, VAT number (if you have one), and contact info. Getting this right now means every invoice you create will be automatically and correctly populated from day one. -

Customise Your Invoice Template

Now for the fun part: making your invoices look like yours. Upload your logo and pick out your brand colours. A sharp, branded invoice isn't just about looks; it reinforces your professional image and builds client trust right from the start. -

Add Your Clients and Services

Start loading in your client list and a catalogue of your services or products. Taking a few minutes to enter this information now-along with your standard rates-will turn future invoicing into a simple point-and-click job.

This initial data entry is a one-time task that pays dividends immediately. By pre-loading clients and services, you cut out repetitive typing and slash the risk of making mistakes on every single invoice you send later.

-

Connect a Payment Gateway

Want to get paid without any friction? Connect a payment gateway. Linking up services like Stripe or PayPal lets your clients pay you directly from the invoice with a credit card or bank transfer. It’s the easiest way to close the loop. -

Send a Test Invoice

Finally, before you go live, send a test invoice to yourself or a trusted colleague. This is your chance to see the whole process through your client's eyes-check the layout, make sure the payment links work, and see what the email notifications look like. It's a quick final check that guarantees a smooth experience for everyone.

Got Questions? Let's Get Them Answered

Dipping your toes into the world of free invoice software can bring up a few questions. That's perfectly normal. Getting straight answers helps you pick the right tool with confidence, making sure it does what you need without any nasty surprises later on.

Is "Free" Genuinely Free? Or Is There a Catch?

It’s the biggest question on everyone’s mind, and the short answer is: yes, but with limits. Most free invoice software runs on what’s known as a freemium model.

Think of it like a pay-as-you-go phone plan. The basic features-like creating and sending a handful of invoices-are genuinely free. But when you need more advanced stuff like automated payment reminders, handling different currencies, or adding more people to your team, that’s when you’ll be prompted to move to a paid plan.

So while there are no direct hidden costs, the limitations themselves can become an indirect one. Say your free plan caps you at five invoices a month. The moment you land that brilliant sixth client, you’ve got a choice to make: upgrade or find a new system. The "cost" is the subscription you’ll need to pay to keep your business running smoothly.

Before you commit, always have a good look at the provider's pricing page. Understand exactly where the free tier ends and what it will cost you to grow.

Can These Free Tools Handle UK VAT and MTD?

Absolutely. Many free invoicing tools are built with the UK market in mind and handle VAT calculations just fine.

The key thing to look for is HMRC Making Tax Digital (MTD) compliance. If you're a VAT-registered business, this isn't just a nice-to-have; it's a legal requirement for keeping digital records and submitting your VAT returns. A compliant tool makes this whole process much less of a headache. Just be aware that MTD features are sometimes reserved for paid plans, so it's vital to check this before signing up.

How Safe Is My Business Data in a Free Tool?

This is a great question to ask. Reputable software companies take data security incredibly seriously, even for their free users.

They typically use industry-standard security like SSL encryption to protect your information as it travels between your computer and their servers. It’s the same technology your online bank uses to keep your financial details safe. Your data is usually stored in highly secure, cloud-based data centres with multiple layers of protection. The best advice? Stick with a well-known provider that has a clear, easy-to-understand privacy policy.

Ready to get your invoicing sorted and get paid faster? InfraZen Ltd offers IT strategy and support that helps creative businesses implement the right tools for growth. Find out how we can help your business thrive.